- 股票掌故

- 香港股票資訊

- 神州股票資訊

- 台股資訊

- 博客好文

- 文庫舊文

- 香港股票資訊

- 第一財經

- 微信公眾號

- Webb哥點將錄

- 港股專區

- 股海挪亞方舟

- 動漫遊戲音樂

- 好歌

- 動漫綜合

- RealBlog

- 測試

- 強國

- 潮流潮物 [Fashion board]

- 龍鳳大茶樓

- 文章保管庫

- 財經人物

- 智慧

- 世界之大,無奇不有

- 創業

- 股壇維基研發區

- 英文

- 財經書籍

- 期權期指輪天地

- 郊遊遠足

- 站務

- 飲食

- 國際經濟

- 上市公司新聞

- 美股專區

- 書藉及文章分享區

- 娛樂廣場

- 波馬風雲

- 政治民生區

- 財經專業機構

- 識飲色食

- 即市討論區

- 股票專業討論區

- 全球政治經濟社會區

- 建築

- I.T.

- 馬後砲膠區之圖表

- 打工仔

- 蘋果專欄

- 雨傘革命

- Louis 先生投資時事分享區

- 地產

Random Tags

對比 Barrons

http://barrons.blog.caixin.com/archives/45029「銀行信用擴張驅動了商業週期的所有階段:以貨幣供應擴張和不良投資為特徵的,膨脹的繁榮時期;危機在信用擴張停止時到來,讓不良投資得以暴露;以及蕭條式的恢復,這一必需的調整過程讓經濟回到最有效率的方式來滿足消費者的需求。」

---Murray Rothbard《美國大蕭條》

"Thus, bank credit expansion sets into motion the business cycle inall its phases: the inflationary boom, marked by expansion of themoney supply and by malinvestment; the crisis, which arrives whencredit expansion ceases and malinvestments become evident; and thedepression recovery, the necessary adjustment process by which theeconomy returns to the most efficient ways of satisfying consumerdesires. "

---Murray Rothbard 《America's GreatDepression》

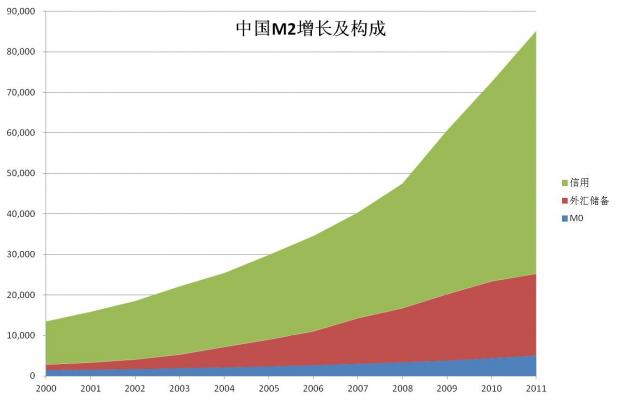

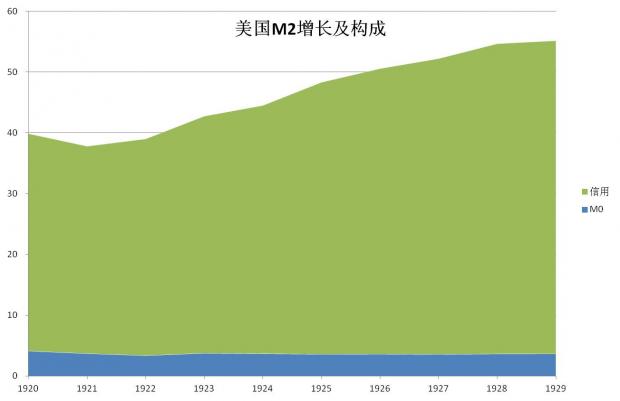

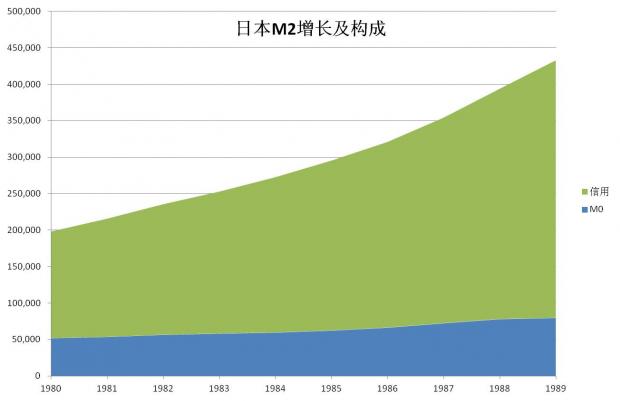

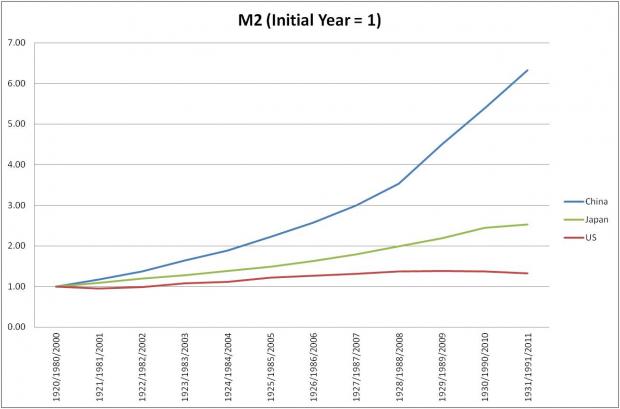

M2的變化。紅線為美國,起始年份(1920)為1。綠線為日本,起始年份(1980)為1。藍線為中國,起始年份(2000)為1。

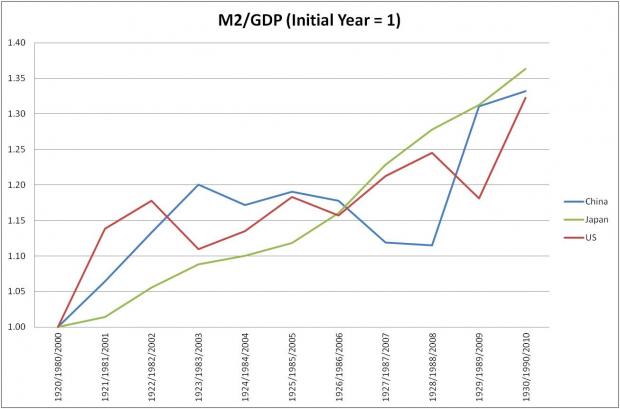

M2與GDP的比值變化。紅線為美國,起始年份(1920)為1。綠線為日本,起始年份(1980)為1。藍線為中國,起始年份(2000)為1。圖中可見四萬億的作用。

PermaLink: https://articles.zkiz.com/?id=76113

Next Page