- 股票掌故

- 香港股票資訊

- 神州股票資訊

- 台股資訊

- 博客好文

- 文庫舊文

- 香港股票資訊

- 第一財經

- 微信公眾號

- Webb哥點將錄

- 港股專區

- 股海挪亞方舟

- 動漫遊戲音樂

- 好歌

- 動漫綜合

- RealBlog

- 測試

- 強國

- 潮流潮物 [Fashion board]

- 龍鳳大茶樓

- 文章保管庫

- 財經人物

- 智慧

- 世界之大,無奇不有

- 創業

- 股壇維基研發區

- 英文

- 財經書籍

- 期權期指輪天地

- 郊遊遠足

- 站務

- 飲食

- 國際經濟

- 上市公司新聞

- 美股專區

- 書藉及文章分享區

- 娛樂廣場

- 波馬風雲

- 政治民生區

- 財經專業機構

- 識飲色食

- 即市討論區

- 股票專業討論區

- 全球政治經濟社會區

- 建築

- I.T.

- 馬後砲膠區之圖表

- 打工仔

- 蘋果專欄

- 雨傘革命

- Louis 先生投資時事分享區

- 地產

Random Tags

I am not wrong,I am early. 蔡東豪

2008-08-28 NextMagazine我 從事過不少行業,在加拿大做證券分析員的幾年時間,是我特別回味的一頁。一九九○年我在一間獨立證券公司工作,公司業務集中證券買賣,專注賺取佣金,不涉 及投資銀行業務,因此分析員可暢所欲言。當時我入行不久,沒有資格做整個行業的分析工作,美其名負責Special Situations,實際是負責其他同事不會做分析的公司。因此,我所分析的公司非常「立雜」,令我「一炮而紅」的,是分析經營殯儀館的盧雲集團 (Loewen Group)。

盧雲在加拿大西岸起家,不停收購殯儀館,猶如一部不會停止的機器,闖入美國市場,業務規模以幾何數字倍升,股價跟隨盈利急升,成為股市奇葩。盧雲主席Ray Loewen的名字在傳媒中無處不在,股市中人跟紅頂白,把他捧至天高,故事完美。

在加拿大任職分析員的最大樂趣,是公司要求分析員著重分析的「深度」,而非「廣度」;這也是我對財經演員「逢股必懂」絕技嘆為觀止的原因。當年我分析的公司,數目只有五至六間,對它們都有一定掌握。

我 從最基本做起,訪問殯儀館負責人,了解大集團收購殯儀館,究竟是一回什麼事情,「協同效應」究竟怎樣產生?盧雲故事的賣點是:收購家族式經營的殯儀館後, 立即進行一連串企業化改革,例如加入專業管理、現代營銷手法、中央採購和處理等。換句話說,開源方面是二加二等於五,節流方面是二加二等於三。盧雲不停收 購,公司賬目複雜至無法理解,分析員只好照單全收他提供的資料。

他的經營模式不是獨有,有一個詞語去形容不斷併購同業的做 法,叫「整合者」(Consolidator)。「整合者」選擇的行業必定具備的特徵,是龍頭企業佔的市場份額不高,業內大多是散兵游勇,表面上適合「整 合者」去一統天下。它曾出現於八十年代北美洲的廢物處理、錄影帶租賃等行業,初期氣勢如虹,可是最後無以為繼,甚至破產收場。行不通的原因,是所謂「協同 效應」根本不存在,愈併購愈出現問題,一加一只等於二,甚至更差。投資者最初以為上市公司盈利持續每年增長三成,三十倍的市盈率不貴,但當增長速度稍有差 池,便立即離棄,股價崩潰。

我訪問過多間殯儀館的負責人,發現殯儀業是一個無法整合的行業。在北美,殯儀業是一種社區服務,殯儀館以家族式 經營,一代傳一代,賣點不是「平靚正」,而是關懷。殯儀館負責人低調地參與社區服務,便是殯儀業的營銷活動。殯儀館的生意來源大部分來自本區,而國籍、宗 教、文化、習俗等因素非常重要。簡單說,殯儀業不可能以「曲奇餅」式去倒模出來。有收看過美國電視劇《六尺風雲》(Six Feet Under)的讀者,應該記得主角的殯儀館也曾考慮把祖業出售予「整合者」的橋段。

我發現盧雲的收購手法令不少家族式經營的殯儀館負責人感不滿。盧雲收購後,必定提高收費, 一九九○年美國殯儀服務的平均消費高達八千美元(去年是六千美元),引起消費者團體不滿;不少團體自組廉價殯儀服務,跟大集團抗衡。

計完數後,我充滿信心,寫了一份詳盡分析報告,建議客戶沽售盧雲的股票。報告發表後,引起市場爭議;盧雲先生寫了一封信給我,警告我說話要小心,保留法律追究權利云云。我心想他真的控告我,我就立即成名,但他最後沒有控告我。

盧 雲股價沒有因我的報告下跌,反而不停升,升至我成為行內笑柄。報告發表後一兩年,我仍堅持自己的分析,除了一小撮殯儀業人士視我為英雄(多次邀請我在殯儀 業會議上發言),分析員行家和客戶則視我為傻瓜。後來我回流香港,沒有跟進盧雲。到了一九九九年,我收到一位加拿大朋友的來信,他告訴我盧雲終於爆煲,宣 布破產。報章報導這宗新聞,也提起過許多年前有一位分析員曾作出盧雲爆煲的預言。

事實證明我沒有看錯,但時間上早了九年。假如客戶當日接納我的分析沽空盧雲,他們必定比盧雲先行破產。這故事教訓我,時間性是分析的重要一環,分析正確但時間不對也等於錯。

自盧雲一役,我不再相信併購後的「協同效應」,但不敢不信一個基本上行不通的併購模式,可令公司股價在一段時間(甚至是一段長時間)升至停不了。投資的時候不要糾纏對與錯,最重要的是在對的時候做對的事情。

蔡東豪Tony Tsoi

現任上市公司精電國際行政總裁,港交所上市委員會副主席。他曾任職投資銀行,在《信報》以筆名原復生撰寫財經專欄,對投資及求知有無限渴求,習慣早上四時起床寫作找樂趣。

Design for Fun Why not?

http://www.cbnweek.com/yuedu/ydpage/?raid=2156有些設計看起來好像沒什麼了不起,但你總會在見到它的第一眼就會心一笑,或者很大聲地笑出來。這種設計會存在於各種你想得到或者想不到的物品中,除了好玩,也不知道還有什麼辦法將它們歸成一類,我們就姑且稱之為「Fun Design」吧。

比如你在右圖看到的這調味瓶,設計師色鑫甚至被朋友調侃出了「要讓媽媽繫著圍裙,在廚房裡轉上一圈,再往鍋裡撒鹽」的用法。它看起來就像是一根仙女棒,而用法也正是這樣。

這是一個看著動畫片就蹦出來的創意。色鑫都已經記不清是哪部片子了,只記得當仙女棒和調味罐的兩個想法在腦中碰到一起的時候,他立馬就在紙上畫下草

圖,然後花了一個晚上做出了設計稿。靠靈感來設計是色鑫最喜歡的工作方式—「靈光一現的創意總是既能打動自己,又能打動別人。」

每天睡覺前,色鑫都會記得放一個小本子在枕邊,若是晚上夢見了有趣的事情,就可以在醒來時把夢境畫下來。一次他夢見小時候在東北鑿冰釣魚的場景,醒來

就畫出了一隻水晶魚缸:從上往下看,就像鑿開的冰窟窿,魚在裡面游著。他還會定期整理這些夢,給最喜歡的幾個畫上錐形的記號,以備沒有靈感的時候翻看。不

過靠靈感來完成的這些設計都只是色鑫的業餘之作,他的主業曾經是摩托羅拉的手機工業設計師—你知道,自從摩托羅拉裁員事件之後,這就是「曾經」的事了。

在Fun Design的設計師圈子裡,根據夢境來做設計的人並不止色鑫一個。當然,前提是你的夢要足夠有趣。澳大利亞設計師Sophie

Farquhar一直記得小時候那個留著口水的夢—她睡在一片鋪滿了黃油的土司面包上,蓋的是意大利麵做的被子,枕頭也是黃油做的。這是她現在設計的

Bed

Toppings床單系列的雛形—這個床單品牌已經有4種款式,你可以分別躺在一盒巧克力、一個沙丁魚罐頭、一隻鉛筆盒裡,或者躺在草地上,蓋著滿是鮮花

的被子。

但Bitplay設計公司做的那個可以被一槍打倒的燈「BANG!」,雖然就像翻版了每個小男孩都曾有過的打滅路燈的壞孩子幻想,卻不算是一個突然想

到的點子。「最開始我們只是在討論開關一個東西有哪些不同的方法,」張珈偉說。他是這家只由三個設計師組建的台灣設計公司的老闆,那時他們剛組建公司,需

要設計出第一個產品來開張,但還沒人知道那會是什麼。

這場討論的初步結果是以槍擊中開關的方式來控制電源,就像打靶一樣,靶心是開關。這至少實現了遠距離控制開關的設想,但張珈偉和同事們覺得這還不夠有

意思。接下來的幾次討論,才出現了用槍直接打燈,使其熄滅的新想法。這之後,他們更進一步地希望燈被打滅時有被擊倒在地的動態,不過這一點因為操作上容易

損壞燈泡而被否定了。最後,一個折衷的方案是,被擊中的檯燈罩歪向一邊,像頭耷拉下來的樣子。

對於張珈偉來說,好產品的標準就是自己會不會喜歡,會不會一看到就興奮地想要買來送人。這是一個很模糊而主觀地界定,似乎無章可循,不過他知道怎麼樣做出那樣的東西來。

「要把真實的感覺做出來,產品才會有好玩的地方。」張珈偉一直在提醒我們注意「BANG!」被打滅時迅速低頭和被打醒後慢慢抬頭的速度是不一樣的—「如果你是被打倒在地之後醒來,不可能是馬上跳起來的,只能是慢慢地爬起來。」

而他們用來打燈的那把手槍,也是根據一把真槍的輪廓做出來的。不過張珈偉在這裡控制了這把槍的逼真程度:「我們的槍要長得像槍,但又不能太像真槍,它

需要是一個符號。長得像槍,是要讓每個人看到它就能直接拿起來扣動扳機;不能太像,是不要讓用戶分心去研究槍上的細節,而忽略了槍燈的整體概念。」

但另一個台灣設計品牌Urban

Prefer卻不會在「好玩」這個點上糾結那麼多細節。工業設計部設計總監陳志和給他手下的設計師們列了一張表,上面有三十多種產品設計的切入方法,「做

設計的時候經常就是自己坐在那邊畫,很容易忽略掉很多東西,這張表就像一個reminder一樣能夠提醒你。」這張表上包括了功能、實用性、材質、顏色、

造型、與使用者互動等方面,幽默並不排在特別靠前的地方。「Fun之於我們的設計,就像是一碗牛肉麵裡加了蔥一樣,它可能是稍微提味一點,讓你覺得更容易

接受。」

Urban Prefer執行工業設計師陳政隆的作品「COIN

4」就是在這個設計方法表的指導下完成的。設計的初衷是要找到一種用隨身的小物件就可以把iPhone支立起來的方法。「我們在考慮這個設計的時候,市面

上已經有兩種支立iPhone的方法。一種是iPhone殼之外的周邊產品,它們佔空間又容易丟。另一種是直接做在iPhone殼上的支架,但它們又很容

易損壞。所以我們想能不能利用隨身攜帶的東西跟外殼做一個搭配,很容易使用,也不會忘記它。硬幣就是我們想到的身上最常有的物件。」

當你從身上找出一枚硬幣,隨意插入COIN

4上的縫隙中,把iPhone支立起來的時候,確實會為它解決問題的巧妙性會心一笑的。這種藏在功能背後的幽默感是這個創意與生俱來的。要證明這一點,你

只要看陳政隆在完善這個設計的過程中,只是修改了幾十稿插硬幣的縫隙的線條組合,以達到最適合品牌風格的圖樣。

香港品牌ZAN'S的創始人Florence

Wong也是用類似的方法做出了「蜂巢吸管冰格」。甚至在看到產品之後你都能倒推出她當時的想法:浮在飲料上面的冰塊只會讓上半部分冷卻,下面還是熱的,

如果讓冰塊包圍吸管,喝到的飲料就可以均衡地涼下來了。「如果你能在生活中找到一些不方便的地方,然後嘗試去解決這些問題,那就能做出很好的設計。在有了

這樣特別的功能之後,再給它一個美麗的外表,就能做成一個又有用又好看的產品。而且如果它解決的是很多人的問題,那就會很好賣。」

你要在淘寶上找到這些好玩的(也許還帶點古怪的東西)並不難。

2007年,周毅就開了一個叫作「愛稀奇」的網站,上面都是他從國外的創意、設計類博客或者設計公司網站上看來的「小玩意兒」。但隨著發佈的內容和到

訪的瀏覽者越來越多,周毅總能聽到一個問題:「這東西不錯,哪兒有賣?」於是2008年,他找到了幾件產品的代銷公司,開了同名淘寶店。

代銷意味著不便宜,而不便宜是周毅和買家都不願意看到的事情。周毅曾經賣過一款叫作「收集陽光罐子」的太陽能燈─你讓那個罐子形狀的東西曬夠太陽,晚

上它就會發光。但這個看起來很浪漫的創意在代理商加價之後售價398元,比英國本土的售價貴了一倍。周毅決定跳過代理,自己控制售價體系。雖然這樣會增加

庫存風險,但價格下降,也會拉動銷售。現在,「收集陽光罐子」在愛稀奇淘寶店標價269元,最好的時候,一個月能賣出30個。

愛稀奇現在一共出售300種創意商品,供貨商達到50家至60家。相繼有設計師找到周毅,希望以這裡為銷售和推廣的起點。周毅是一個「正版潔癖患

者」:他認為自己的消費者裡面,因為質量而考慮購買正版的人群不到一半,大多數人都只是因為有「正版潔癖」,哪怕消費不起也要買正版。對於籍籍無名的新產

品而言,擁有獨一無二的創意才是關鍵,而另一個比版權更重要的事情是:把創意變成產品。

這看起來是再基礎不過的事情,但很多創意不過就是一個創意而已。色鑫做出將仙女棒調味瓶生產出來的決定已經有大半年的時間了,這期間他還特地向公司請了3個月的假,待在深圳的工廠裡,盯著調味瓶模具的開模。

他在摩托羅拉時,是一個「高高在上」的設計師,從產品概念出來之後,畫完草圖,再做出3D方案,任務就算基本完成了。只要跟工廠確認好設計方案,剩下的生產,工廠會嚴格按照設計的要求來完成。

但輪到自己生產調味瓶時,不僅要自己仔細檢查每一次出來的樣品有多少瑕疵,還需要跟工廠確認下一步改進的方案,而且因為他的訂單量不到5000個,這

在通常都接10萬級訂單的工廠很難有話語權,他甚至因為工期和質量問題換了合作的工廠。這是他第一個從設計稿變成現實的產品。在試圖量產的這大半年裡,他

將那些詢問哪裡可以買到調味瓶的郵件陸續整理好,覺得等到自己要正式開賣的時候一定還派得上用場。但要怎麼去賣,他好像還沒有靜下來認真計劃過。

張珈偉以為自己有足夠經驗,已經將「BANG!」在量產中可能遇到問題的很多細節都砍掉了,「燈上其實還可以加更多東西的,比方說不同角度的旋轉、不

同顏色,但是我們都不要,因為知道那會在生產時造成更多的麻煩。」但他們還是為了布制燈罩和塑膠燈座這兩種材質不同的部件能夠呈現出統一的白色,在工廠花

了幾個月的時間去調顏色。

「我們發現設計在整個環節中居然是比重很輕的一環,都開始懷疑自己還是不是設計師,我們公司還是不是設計公司了。」作為設計師,張珈偉和他的同事曾經

一直認為設計是產品生產最重要的環節,但目前從時間上來看遠不是如此。他們往往是花1個月時間設計一個產品,然後花上1年才能量產出來,再花上半年才能鋪

好銷售渠道。結果就是,這家成立了2年多的公司,目前在市面上銷售的產品還只有兩個。

「設計師往往過於專注設計本身,而且因為推廣的投入很多,牽扯的精力也大,他們往往不能兼顧好。」周毅說,「工業設計師要真正參與量產,需要很多包容。」他的意思是,因為預算,要允許成品比設計稿質量下降一些。

不過話說回來,考慮到預算的設計,才應該是好設計。即便設計師不能像蘋果一樣在工藝上有強勢的話語權,也可以在idea階段就儘量考慮周全。

To Serve, To Strive and not To Yield! 朱泙漫屠龍記

http://johnchrysostom.blogspot.hk/2012/10/to-serve-to-strive-and-not-to-yield.html「To Serve, To Strive and not To Yield!」是以前筆者參加外展訓練(Outward Bound)時學會的口號。其中高台跳水和游繩攀石(Abseiling)的項目是其中兩項令人印象深刻的活動。由於有些人畏高,因此往往不能完成這些項 目。在懸崖游繩下坡之際,人必須往後仰才可以重心配合腳踏在懸崖邊而利用安全繩滑下。這些經歷令筆者明白安全繩固然非常重要,但人必須明感覺上的風險和實 際的風險可能是兩回事。

- 自科網狂潮爆破後,中移動(00941:HK)一直跌至2003年4月28日的收市價港幣12.80元才見底。其後緩緩而有力地穩步上升, 直至2007年8月上旬受美國次按風暴陰影下開始郤步並調整至2007年8月17日的低位港幣75.60元。豈料當天溫爺爺宣佈港股直通車,在這大奇蹟日 中移動(00941:HK)在下午急彈並以港幣80.95元收市。在2003年4月28日至2007年8月17日這漫長的期間,中移動 (00941:HK)升勢穩定而緩慢。

- 自中國宣佈擬開通港股直通車後,中移動(00941:HK)由2007年8月17日收市價港幣80.95元一直夾上至2007年10月30日收市價港幣158.20元,這段正是十年不逢一潤單邊大升市。

- 其後因港股直通車政策神秘地消失回次按風暴不段擴大,中移動(00941:HK)由2007年10月30日收市價港幣158.20元一直插水至2008年10月17日收市價港幣66.10元才見底回升。同樣地,這段亦是十年不逢一潤單邊大跌市。

- 由2008年10月17日起,中移動(00941:HK)在大約港幣70.00元至港幣85.00元區域上下浮動,這是典型的無方向性(Directionless)走勢。

The World is Not Enough! 朱泙漫屠龍記

http://johnchrysostom.blogspot.hk/2013/04/the-world-is-not-enough.htmlShadow banking is not the issue 張化橋

http://blog.sina.com.cn/s/blog_50c88c400101kmjr.htmlThe real problem behind China's shadow banking;

http://www.scmp.com/comment/insight-opinion/article/1249826/real-problem-behind-chinas-shadow-banking

Joe Zhang,

But why is shadow banking still all the rage, despite thehostile regulatory environment?

In the past two to three decades, China has implemented anextremely inflationary monetary policy. Since 1986, for example,its money supply has grown at a compound annual growth rate of 21.1per cent, and its bank loan balance by 18.2 per cent. Of course,Chinese citizens have not become richer as fast, and much of thegrowth is merely a monetary illusion.

Why did credit grow so fast for so long? Apart from a robusteconomy, the reason has been the regulated and negative realinterest rate. Due to financial repression, demand for loans hasbeen artificially boosted, as bad investments become feasible onsubsidised credit. Indeed, it has been a vicious cycle.

First, the fast growth of loans worsens inflation, which weakensthe purchasing power of money. To facilitate the same amount ofbusiness, corporate China needs more credit. And as more credit isreleased into the economy, the purchasing power of money shrinksfurther. I call this an iterative escalation of credit andinflation. There is a constant shortage of credit no matter howfast credit grows. The reason? Bank loans are impossible to refuseas they are heavily subsidised. Homebuyers and speculators knowthis all too well.

The Chinese government frequently talks about prudent monetarypolicy but does not really have the political will to tightencredit for fear of job losses and a recession. Even in April, thebroad money supply (M2) has grown at 16.1 per cent compared to thesame time last year. That is a very high rate on a high base. Chinais still inflating rapidly despite repeated declarations of creditcontrols by government officials.

The results of financial repression are visible everywhere, fromindustrial overcapacity to excess real estate construction, and theunstoppable growth of shadow banking.

Over time, the Chinese statistics (particularly on inflation)have lost credibility among citizens. Despite high inflation thatis widely believed to be somewhere between 5 and 10 per cent ayear, Chinese depositors are paid an average of 2 per centinterest. Naturally, they want better deals. While many have chosento speculate on property, others have embraced shadow banking,including microcredit and wealth management products. Afterconsistently deflating for two consecutive decades, the domesticstock market remains very expensive, with banking stocks being thepossible exception.

Negative real interest rates on bank loans constitute a subsidyfor borrowers. Unfortunately, access to finance is neither equalnor fair. State-affiliated companies and well-connectedprivate-sector borrowers take the bulk of funds for loans, leavingvery little for small businesses. The underprivileged have toresort to the curb market, involving trading outside the officialstock markets, pawnshops, microcredit firms and high-cost fundsarranged by trust companies.

In other words, China's shadow banking is a reflection of thefinancial repression. The high interest rates prevalent in shadowbanking activities are a result of the low rates in the formalbanking sector.

Financial repression has accentuated the uneven playing fieldfor the two types of borrowers. Normal bank loans carry a 6 percent annualised interest rate, while the shadow banks typicallycharge 15-30 per cent per annum.

If Beijing really wants to help small businesses, or deflate theproperty bubble, it should raise interest rates steadily. As aresult, the growth rate of money supply will decline to 7-8 percent within two to three years. Yes, this will risk an economicrecession, but a recession may be exactly what is needed to avoidthe next global financial crisis. This time, unlike in 2008, thecrisis will be made in China.

China's iterative escalation of credit and inflation has severesocial consequences, too. Ordinary savers are punished, and areleft further and further behind by the rising prices of assets suchas property. If President Xi Jinping wants Chinese people torealise their own "China dream", he must tame the credit monster.Shadow banking is only the shadow, not the monster waiting in theshadows.

Joe Zhang was chairman of Wansui Micro Credit Company inGuangzhou from 2011 to 2012, and is author of a new book, InsideChina's Shadow Banking: The Next Subprime Crisis?

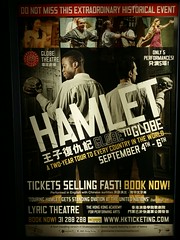

To be, or not to be by C2

來源: http://www.hunghuk.com/2015/09/07/to-be-or-not-to-be/To be, or not to be

這句經典的對白,不少人都知道是出自沙翁的名劇Hamlet 王子復仇記。終於昨天有幸看到此劇在港公開演出,香港站是其中一站,其中還有香港演員,不得不支持一下。

Hamlet 王子復仇記為沙士比亞四大悲劇之一,好友在我看之前問我,看完是否會哭? 我笑說不會的….

昨天此劇在演藝公演,整個舞臺及製作都很簡單,8名演員分演多角,每幕完結後都自行移送臺上道具,另外道具背景都非常簡單,是筆者從未見過,每幕之間也無需落幕,使全劇節奏緊湊….當中編劇已加入很多唱歌和音樂元素,跟傳統很不一樣….

結構方面都是以一貫的作風。其中的獨白、鬼角及現實及虛幻(illustration)都是我最喜歡及認為是其不可或缺的元素,不過我最喜愛的女巫師(witch)卻不在此劇。

希望再有機會再在港看其他劇目的演出,不怕悶、不怕難明、也不怕自己一個去看……如問我想看什麼?我會說仲夏夜之夢,因是喜劇吧!

To watch or not to watch? Yes!

G2G...not apathy....retoring

May 22 (Bloomberg) -- European Union finance ministers pledged to stiffen sanctions on high-deficit countries and ruled out setting up a mechanism to manage state defaults, saying no euro country will be allowed to renege on its debts.Generally, the above news, delivered a simple message to me. G to G affairs are much easy to compromise. Further more, an old idiom;

官字,两个口

The scenario is vary from the US government provides the rescuse package, TARP, to those financial institutionals. During then, the US governement has the right to rescuse or reject any financial institutionals. It's not a NATIONAL INTEREST or to protect its' prestigous.

EU is a body, which many countries are involved. Failure of any country in the EU, swaying others is a forgone conclusion. Hence, in the "Malaysia context" of understanding how the EU countries responsding toward the Greece fiscal problem;

"You help me, I help you"

I'm turning positive, seeing the rich countries in the EU, toned decisive to halt the potential European sovereign debt crisis;

Deliberations over the revamp of Europe’s economic management came after German Chancellor Angela Merkel won parliamentary backing for Germany’s contribution of as much as 148 billion euros to the EU’s planned 440 billion-euro debt- stabilization fund, the largest single share.

“Forget the treaty, let’s focus on what we can achieve in the short term,” French Finance Minister Christine Lagarde told reporters. “We are not against change, but let’s see what is deliverable very quickly.”

After all, a US$1 trillion had been allocated in this effort. Will the EU willing to see the US$1 trillion futiled?

預防勝於治療

404 not found cities

ASX merger may not make good sense, but it now looks a good bet

1 : GS(14)@2011-02-12 17:42:53http://www.smh.com.au/business/a ... 20110211-1aqp7.html

2 : 鱷不群(1248)@2011-02-12 20:23:22

港交所不如與NASDAQ合併,否則客易落後形勢

3 : GS(14)@2011-02-13 12:02:17

但是Nasdaq有甚麼好處呢?

4 : 鱷不群(1248)@2011-02-13 14:25:19

3樓提及

但是Nasdaq有甚麼好處呢?

其他都商討合併,無選擇了,Nasdaq和香港處身不同時區,又擅長洐生工具

5 : GS(14)@2011-02-13 14:26:57

4樓提及3樓提及

但是Nasdaq有甚麼好處呢?

其他都商討合併,無選擇了,Nasdaq和香港處身不同時區,又擅長洐生工具

又是,的確是一個不錯的建議,最怕對手估值太高,為合併而合併,確實無好下場

越禁越熱 天與地 is not dying

1 : GS(14)@2011-12-30 12:13:05http://www1.hk.apple.nextmedia.c ... 462&art_id=15937200

縱然收視低,卻成為城中熱話的無綫劇《天與地》,被內地禁播後引起內地網民越禁越想睇,瘋狂搜尋視頻,令該劇昨日成為內地著名網站天涯論壇的搜尋榜 no.1。劇中黃貫中創作的兩首主題曲《天與地》及《年少無知》也熱爆,但兩歌不受無綫重視,在《勁歌》榜均食白果,明年總選亦無緣攞獎。

2 : 草帽(1253)@2011-12-30 13:34:09

如果套野既世界再涼博一D會更好. 不過而家都有D味道.

3 : orz(6886)@2011-12-30 14:14:12

我幾鐘意睇這套劇, 劇本拍攝手法一流, 最重要是演技比tbb熱棒的小生花旦更勝一籌

4 : GS(14)@2011-12-30 16:10:36

2樓提及

如果套野既世界再涼博一D會更好. 不過而家都有D味道.

人生沒希望會好痛苦,難入口...

成套戲無邊個無做錯事

5 : killer2012(20151)@2011-12-30 16:23:26

i am dying

6 : GS(14)@2011-12-30 16:26:40

5樓提及

i am dying

點解?

7 : 草帽(1253)@2011-12-30 17:44:32

如果三個主角唔好係D精算師, 只係D朝九晚五打工仔. 又或者賣保險, 咁會更辛酸, 更現實, 睇到標晒眼淚, 而家就係少左份投入感.

8 : GS(14)@2011-12-30 17:47:18

其實講到尾,如果唔set呢D,個劇本要重新寫過

9 : 草帽(1253)@2011-12-30 17:51:26

10 : GS(14)@2011-12-30 17:52:29

9樓提及

其實個劇本唔合理,反而set他們是經紀合理D,因為他們打band時最後生那位都20歲,仲好似唔讀書咁...點考乜乜師呢?

11 : 草帽(1253)@2011-12-30 17:55:32

係, 同埋唔讀書打band打到變精算師, 另外一個做左間公司阿head. 唔係好令人接受.

12 : 龍生(798)@2011-12-30 18:40:16

多數下場都係

代客泊車

倉務員

跟車....

13 : mr_dlm(19486)@2011-12-31 15:57:07

4樓提及2樓提及

如果套野既世界再涼博一D會更好. 不過而家都有D味道.

人生沒希望會好痛苦,難入口...

成套戲無邊個無做錯事

咁佢都係因果報應, 其實係正面的

現實更多係好多人一生無做錯事到頭來都不得善終

14 : GS(14)@2012-01-01 15:08:33

13樓提及4樓提及2樓提及

如果套野既世界再涼博一D會更好. 不過而家都有D味道.

人生沒希望會好痛苦,難入口...

成套戲無邊個無做錯事

咁佢都係因果報應, 其實係正面的

現實更多係好多人一生無做錯事到頭來都不得善終

...可能是社會的錯

15 : 龍生(798)@2012-01-01 21:29:23

英耀論中有明言

長輩過於忠厚, 此生定必是愚人....

16 : GS(14)@2012-01-02 11:10:36

15樓提及

英耀論中有明言

長輩過於忠厚, 此生定必是愚人....

但是他一生咪過得好囉,有無睇阿甘正傳?

17 : 龍生(798)@2012-01-03 01:30:47

我明...

但英耀論教的是相人, 而不是處世嘛....

18 : GS(14)@2012-01-03 23:18:36

咁命好不如運好

19 : 亞力士(1473)@2012-01-03 23:44:31

18樓提及

咁命好不如運好

英耀賦唔係講風水命理

Next Page