- 股票掌故

- 香港股票資訊

- 神州股票資訊

- 台股資訊

- 博客好文

- 文庫舊文

- 香港股票資訊

- 第一財經

- 微信公眾號

- Webb哥點將錄

- 港股專區

- 股海挪亞方舟

- 動漫遊戲音樂

- 好歌

- 動漫綜合

- RealBlog

- 測試

- 強國

- 潮流潮物 [Fashion board]

- 龍鳳大茶樓

- 文章保管庫

- 財經人物

- 智慧

- 世界之大,無奇不有

- 創業

- 股壇維基研發區

- 英文

- 財經書籍

- 期權期指輪天地

- 郊遊遠足

- 站務

- 飲食

- 國際經濟

- 上市公司新聞

- 美股專區

- 書藉及文章分享區

- 娛樂廣場

- 波馬風雲

- 政治民生區

- 財經專業機構

- 識飲色食

- 即市討論區

- 股票專業討論區

- 全球政治經濟社會區

- 建築

- I.T.

- 馬後砲膠區之圖表

- 打工仔

- 蘋果專欄

- 雨傘革命

- Louis 先生投資時事分享區

- 地產

Random Tags

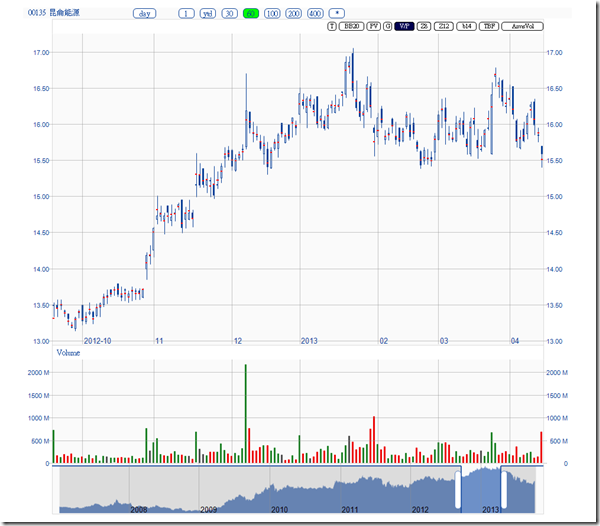

Ztrader – Price Distribution Indicators (1) 港股博弈

http://clcheung.wordpress.com/2013/10/12/ztrader-price-distribution-indicators-1/To determine the support and resistance area, one method I like to use is to collect the statistics of the price distribution and display it visually on a chart.

For example. # 0135 this year, before it collapse next day:

One can draw a support line a about $15.4. Is this support strong enough ?

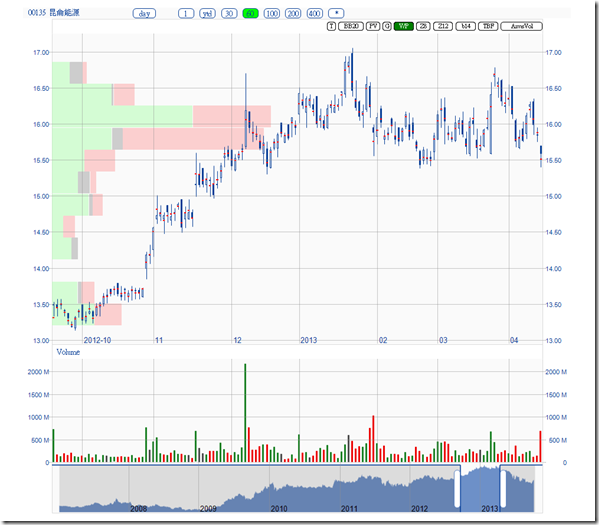

Turn on the Volume by Price indicator, the trading volume of the corresponding price level is accumulated and displayed as an overlay on the chart. Longer the bar, means bigger the trading volume at that price level. Green bar is the volume that closing wih a upward price, pink bar is the volume that closing with a downward price :

One can clearly see the region 15.66-15.95 , is dominated by the pink bar, which indicates an resistance more that a support, more than that, the lastest closing is below that region.

The support region from $13 to $15.6 is very weak, observed from the short Volume/Price line.

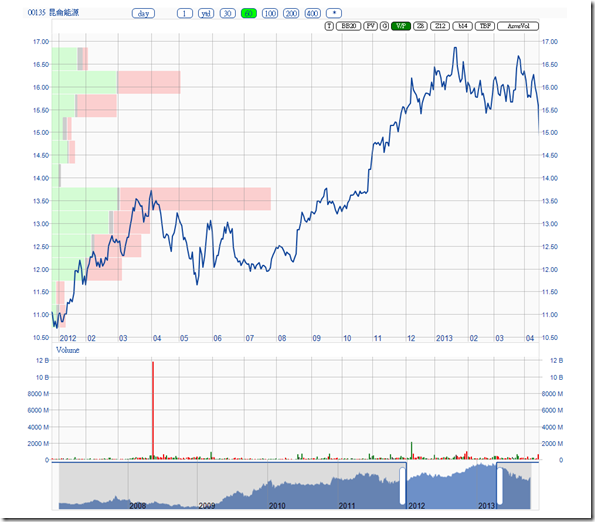

Extend the chart backward to 2012, the major support seems at $13.5.

In the case, it is better to escape rather than bet for a rebound. Follow that day, It collapsed and tried to rebound later:

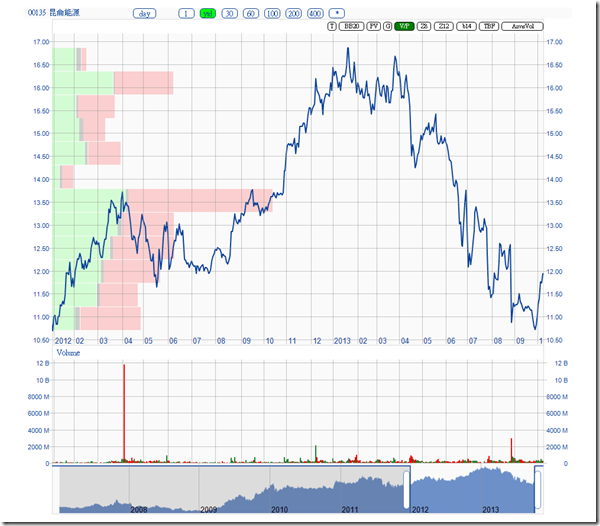

Later it fall through the major support at 13.5:

Re-examine the major support at $13.5, There was a placement in 2012. If exclude that placement, support at $13.5 is not that major:

In fact the 857 corruption event was disclosed in late Aug. It seems a lot of related party already knew the investigation much earlier. The stock price stabilized after the event disclosed. If play this stock based on limited FA resources, it is a real disaster.

BTW, I am not challenging FA by TA. It is just the imbalance of information makes a pure “FA” analysis failed. Stock market is never a fair game.

Ztrader – Market Breath Indicators (1) 港股博弈

http://clcheung.wordpress.com/2013/10/14/ztrader-market-breath-indicators-1/

Oct 14, 2013

Market Breath indicators attempt to guess the direction of the overall market by analyzing the number of stocks advancing relative to the number declining.

Arms Index, called also TRIN, the Trader’s Index, created by Richard Arms, measures the market breath by:

TRIN = (Advancing Stocks / Declining Stocks) / (Advancing Volume / Declining Volume)

When it is below 1.0, the market is considered as bullish. When it is above 1.0, the market is bearish.

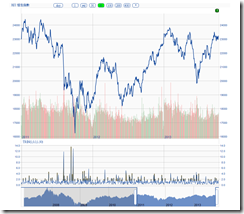

Here, the plot of TRIN since 2011:

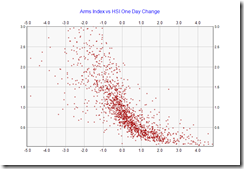

Arms Index against HSI one day change, from 2007 to Oct 14, 2013:

It shows some extreme cases, where TRIN values can shoot up to abnormally high during very bearish market.

If zoom into the “regular” and normal range:

The center of the chart is about at (0.0, 1.0), which indicate when HSI index is no change, TRIN shall be around 1.0. The relative empty areas in upper right and lower left in the chart, indicates the effectiveness of the indicator is confirmed.

Here is the distribution of TRIN between 0 to 3.0 :

The chart shows a more than neutral view. The median value is 0.85, indicates in general the market is on a slightly bullish side.

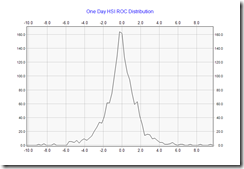

Here is the one day HSI change distribution:

The chart shows a very neutral view. The median value is 0.056%, indicates in general the market is on average very neutral.

If there is a relationship between TRIN and HSI, I would say the neutral point of TRIN value is 0.85 instead of 1.0.

===

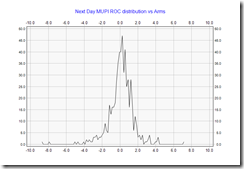

Then how about MUPI distribution ?

The median value is 0.175%. In fact I think TRIN is more correlated to MUPI.

How about TRIN vs MUPI one day change:

Still not easy to read.

===

Prediction Power of TRIN

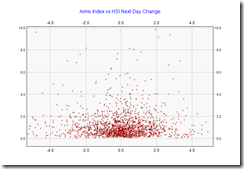

How about using today’s TRIN to predict next day’s market direction ?

Seems no useful relationship.

If only consider TRIN value < 0.6 (a bullish day), plot against the next day performance:

HSI gain is about 0.028%, almost zero prediction value.

If uses MUPI:

Average gain is 0.18%, median 0.27%, better than HSI.

In conclusion, Arms Index is more related to MUPI than HSI. It makes sense. A bullish day indicates the next day shall be a bit bullish also. It has no one day prediction power with one day Arms Index on HSI.

==

While it seems the prediction power of TRIN for next day’s trading is not much, Arms suggested a moving average of TRIN can be used to pick bottoms and tops for the market. Here a 21 days moving average is used and oversold level set to 1.5:

The peaks seems shifted a bit. MUPI version is better :

Except on 2007, the recent lows of the market is quite accurately captured. One can enter the market after the moving average leaves the red zone.

It seems more difficult to predict market tops using this indicator.

In conclusion, it is an effective tool to help locate the market bottom for MUPI rather than HSI.

Next Page