- 股票掌故

- 香港股票資訊

- 神州股票資訊

- 台股資訊

- 博客好文

- 文庫舊文

- 香港股票資訊

- 第一財經

- 微信公眾號

- Webb哥點將錄

- 港股專區

- 股海挪亞方舟

- 動漫遊戲音樂

- 好歌

- 動漫綜合

- RealBlog

- 測試

- 強國

- 潮流潮物 [Fashion board]

- 龍鳳大茶樓

- 文章保管庫

- 財經人物

- 智慧

- 世界之大,無奇不有

- 創業

- 股壇維基研發區

- 英文

- 財經書籍

- 期權期指輪天地

- 郊遊遠足

- 站務

- 飲食

- 國際經濟

- 上市公司新聞

- 美股專區

- 書藉及文章分享區

- 娛樂廣場

- 波馬風雲

- 政治民生區

- 財經專業機構

- 識飲色食

- 即市討論區

- 股票專業討論區

- 全球政治經濟社會區

- 建築

- I.T.

- 馬後砲膠區之圖表

- 打工仔

- 蘋果專欄

- 雨傘革命

- Louis 先生投資時事分享區

- 地產

Random Tags

Ztrader – Volatility (1) 港股博弈

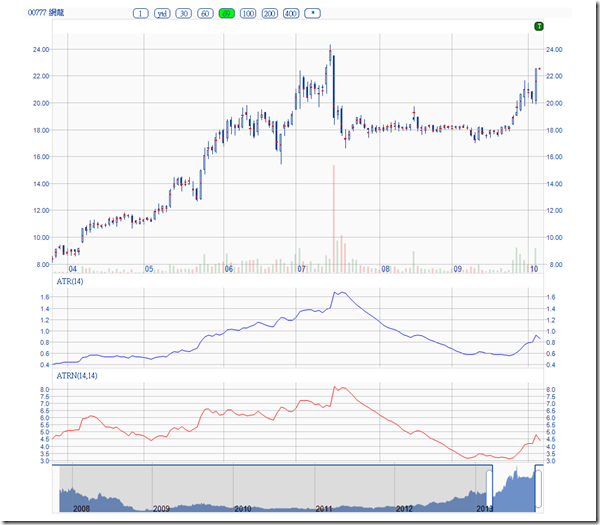

http://clcheung.wordpress.com/2013/10/06/ztrader-volatility-1/Volatility means trading opportunities. One of the famous indicator is Actual True Range, which is easy to construct and understand, for example, # 0777, consolidated for a while and up break the box to make a good advance:

The above chart showing two ATR. The ATRN is a normalized ATR with the SMA of the closing price. Because ATR is an absolution term, it means that you can’t compare one with another. For example, HSI ATR is usually a few hundred points; ATR of # 0777 is $0.5 to $1. ATRN can be used for comparison and for other trading algorithm’s building block.

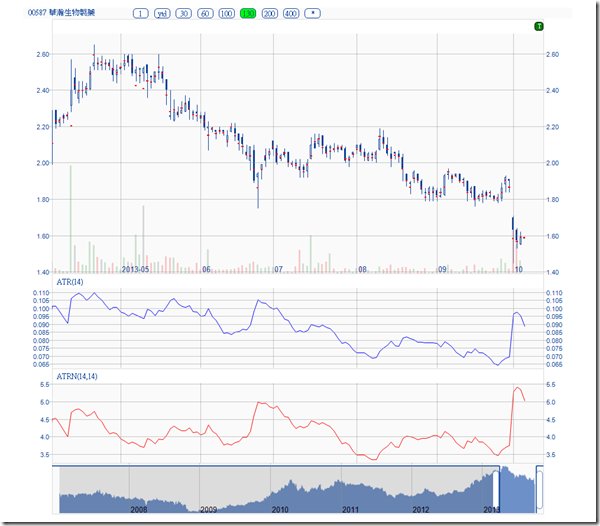

Here is another example of box up break, where ATR shoot up shapely:

Among the various chart pattern, box breakout is one of the most powerful. ATR can be used as a building block to construct such indicators.

A collapsing example:

The ex-dividend effects on ATR indicator is none, if aastock’s old method is used. However, if you construct a normalized ATR, the effect is large in special cases, like 2088 this year:

Here is the old method:

The new method before and after the big dividend payout: Note that the normalized ATRN is not affected in the new method.

There are quite a few trading system based on volatility. Definitely ATR is a useful building block for those systems.

Volatility mean opportunities and risks at the same time. Another use of ATR is to control the bet sizes for future / options trading. Some recommend to use ATR for setting cut loss price points in options trades. It is also useful to measure the overall volatility of a portfolio. Will talk about it in portfolio management later.

Next Page