- 股票掌故

- 香港股票資訊

- 神州股票資訊

- 台股資訊

- 博客好文

- 文庫舊文

- 香港股票資訊

- 第一財經

- 微信公眾號

- Webb哥點將錄

- 港股專區

- 股海挪亞方舟

- 動漫遊戲音樂

- 好歌

- 動漫綜合

- RealBlog

- 測試

- 強國

- 潮流潮物 [Fashion board]

- 龍鳳大茶樓

- 文章保管庫

- 財經人物

- 智慧

- 世界之大,無奇不有

- 創業

- 股壇維基研發區

- 英文

- 財經書籍

- 期權期指輪天地

- 郊遊遠足

- 站務

- 飲食

- 國際經濟

- 上市公司新聞

- 美股專區

- 書藉及文章分享區

- 娛樂廣場

- 波馬風雲

- 政治民生區

- 財經專業機構

- 識飲色食

- 即市討論區

- 股票專業討論區

- 全球政治經濟社會區

- 建築

- I.T.

- 馬後砲膠區之圖表

- 打工仔

- 蘋果專欄

- 雨傘革命

- Louis 先生投資時事分享區

- 地產

Random Tags

Shadow banking is not the issue 張化橋

http://blog.sina.com.cn/s/blog_50c88c400101kmjr.htmlThe real problem behind China's shadow banking;

http://www.scmp.com/comment/insight-opinion/article/1249826/real-problem-behind-chinas-shadow-banking

Joe Zhang,

But why is shadow banking still all the rage, despite thehostile regulatory environment?

In the past two to three decades, China has implemented anextremely inflationary monetary policy. Since 1986, for example,its money supply has grown at a compound annual growth rate of 21.1per cent, and its bank loan balance by 18.2 per cent. Of course,Chinese citizens have not become richer as fast, and much of thegrowth is merely a monetary illusion.

Why did credit grow so fast for so long? Apart from a robusteconomy, the reason has been the regulated and negative realinterest rate. Due to financial repression, demand for loans hasbeen artificially boosted, as bad investments become feasible onsubsidised credit. Indeed, it has been a vicious cycle.

First, the fast growth of loans worsens inflation, which weakensthe purchasing power of money. To facilitate the same amount ofbusiness, corporate China needs more credit. And as more credit isreleased into the economy, the purchasing power of money shrinksfurther. I call this an iterative escalation of credit andinflation. There is a constant shortage of credit no matter howfast credit grows. The reason? Bank loans are impossible to refuseas they are heavily subsidised. Homebuyers and speculators knowthis all too well.

The Chinese government frequently talks about prudent monetarypolicy but does not really have the political will to tightencredit for fear of job losses and a recession. Even in April, thebroad money supply (M2) has grown at 16.1 per cent compared to thesame time last year. That is a very high rate on a high base. Chinais still inflating rapidly despite repeated declarations of creditcontrols by government officials.

The results of financial repression are visible everywhere, fromindustrial overcapacity to excess real estate construction, and theunstoppable growth of shadow banking.

Over time, the Chinese statistics (particularly on inflation)have lost credibility among citizens. Despite high inflation thatis widely believed to be somewhere between 5 and 10 per cent ayear, Chinese depositors are paid an average of 2 per centinterest. Naturally, they want better deals. While many have chosento speculate on property, others have embraced shadow banking,including microcredit and wealth management products. Afterconsistently deflating for two consecutive decades, the domesticstock market remains very expensive, with banking stocks being thepossible exception.

Negative real interest rates on bank loans constitute a subsidyfor borrowers. Unfortunately, access to finance is neither equalnor fair. State-affiliated companies and well-connectedprivate-sector borrowers take the bulk of funds for loans, leavingvery little for small businesses. The underprivileged have toresort to the curb market, involving trading outside the officialstock markets, pawnshops, microcredit firms and high-cost fundsarranged by trust companies.

In other words, China's shadow banking is a reflection of thefinancial repression. The high interest rates prevalent in shadowbanking activities are a result of the low rates in the formalbanking sector.

Financial repression has accentuated the uneven playing fieldfor the two types of borrowers. Normal bank loans carry a 6 percent annualised interest rate, while the shadow banks typicallycharge 15-30 per cent per annum.

If Beijing really wants to help small businesses, or deflate theproperty bubble, it should raise interest rates steadily. As aresult, the growth rate of money supply will decline to 7-8 percent within two to three years. Yes, this will risk an economicrecession, but a recession may be exactly what is needed to avoidthe next global financial crisis. This time, unlike in 2008, thecrisis will be made in China.

China's iterative escalation of credit and inflation has severesocial consequences, too. Ordinary savers are punished, and areleft further and further behind by the rising prices of assets suchas property. If President Xi Jinping wants Chinese people torealise their own "China dream", he must tame the credit monster.Shadow banking is only the shadow, not the monster waiting in theshadows.

Joe Zhang was chairman of Wansui Micro Credit Company inGuangzhou from 2011 to 2012, and is author of a new book, InsideChina's Shadow Banking: The Next Subprime Crisis?

Banking without Banks,寫在Lending Club上市前 點拾Deepinsight

來源: http://xueqiu.com/3915115654/32205235今年的美股出現了許多有趣的新公司,從無人駕駛汽車公司Mobileye,可穿戴設備Re-Walk, 到戶外運動攝像機Go Pro,當然還有全球最大的IPO阿里巴巴。而在接下來的日子中,我們還將看到一個有趣的公司IPO,那就是全球P2P平臺貸的“第一人”Lending Club。

對於P2P相信我們都已經不陌生了,就是英文Peer-to-Peer人人貸的翻譯。這個過去幾年互聯網金融下的新興產物正在以非常之快的速度發展。當然,中國的P2P和海外的還是不太一樣,本文還是主要和大家分析一下美國Lending Club的P2P模式。早在今年5月,著名的《經濟學人》雜誌就寫過一篇文章:Banking without banks。寓意隨著P2P的快速發展,以後人民可能都不需要把錢存銀行了。在英國,P2P以每月翻一倍的速度在增長,目前已經超過了10億英鎊的規模。在美國,Lending Club和Prosper寡頭壟斷了98%的市場份額。他們在2013年一共發行了24億的貸款,比2012年的8.7億美元增長將近3倍。在海外P2P能如此之快的增長源於兩個宏觀大背景的因素:1)海外的量化寬松導致銀行利率接近0,存銀行根本沒什麽收益;2)海外個人融資成本奇高無比。信用卡的融資成本在年化18%左右。所以從存貸款利率的不平衡來看,P2P對於海外的個人投資者有著非常強的吸引力。

商業模式:

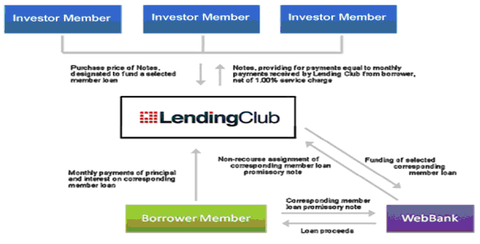

Lending Club的商業模式是什麽?下面這張圖基本可以把問題說清楚。Lending Club本身就是一個人人貸的互聯網平臺。Lending Club的商業模式中核心部分來自於和猶他州實業銀行WebBank(這個銀行一共只有30人)的合作。因為本身Lending Club不是銀行。WebBank向借款人發放貸款後,將債權出售給Lending Club,Lending Club再以債權收益權憑證的形式賣給投資者。這里投資者大部分是個人投資者。換言之,投資人購買的Lending Club發行的“會員償付支持債券”,通過這種形式,放款人就成了P2P平臺的無擔保債權人,而非是借款人的債權人。當平臺上的出借人放出的貸款出現違約時,出借人將獨自承擔投資的損失,Lending Club並不給予補償。在整個交易中,Lending Club扮演的是一個信息媒介的角色,為借貸雙方匹配供需,但不會提供與資金保障有關的其他服務。

對於Lending Club來說,其對借貸人有非常嚴格的標準。包括借貸人最低的信用級別FICO評分要在660之上,負債/收入比低於40%(不包括房貸),至少有3年的信用歷史等等。而根據借貸人提供的信息,信用數據,貸款期限和額度,Lending Club有一套自己的系統以給借貸人評分,從A1到G5一共有35個評級。這套系統也是Lending Club平臺的精髓,許多來自於其過去借貸中的風險回報數據。而筆者也認為這是Lending Club的巨大護城河。隨著其交易平臺的數據越來越多,自有的信用評級系統也會更加完善。這讓後來者非常難以超越Lending Club。

盈利模式:

Lending Club到底怎麽賺錢?Lending Club本身不承受任何風險,通過交易傭金來賺錢。對於投資者來說,Lending Club收取1%的服務費。而對於借款人,Lending Club會在貸款發放的時候向其征收1.1%到5%的“產品設立費”(origination fees)。從盈利模式看,Lending Club和傳統銀行完全不同。傳統銀行是賺利息差的錢(Net Interest Margin)。通過貸款利率和存款利率之間的息差,來獲取利潤。而Lending Club更像一家券商,賺取的是“交易傭金”。由於其互聯網的屬性,能夠平滑貸款和存款利率中的信息不對稱。此外,Lending Club的客戶體驗也非常好。互聯網的口碑效應也導致一種良性循環:Lending Club的交易額越來越多,給公司帶來高速的收入增速。

我們看今年上半年的數據,Lending Club發行的借貸高到18億美元,給其帶來了8690萬的收入。而在一年前,這個數字分別是7.18億和3710萬。我們知道Lending Club大部分的客戶是普通老百姓。但由於其良好的風險控制體系,越來越多的對沖基金和共同基金也開始來購買Lending Club的產品,作為其資產配置的一部分(難怪有人說Lending Club的上市時開創了一種“New Asset Class”)。

中美信用體系的差異:

點拾曾經在早些時候Lending Club的介紹中,和大家分析過中美信用體系的不同。Lending Club能夠在美國做大,和美國完善的信用體系是分不開的。FICO打分,是Lending Club評估用戶風險的重要環節。此外,Lending Club對於美國家庭來說,也僅僅是理財渠道的一小部分。Lending Club的平均貸款額為5500美元,絕對不是有些中國人將自己的主要存款“All In”到某些P2P產品中。。。

長期看法:

長遠看,Lending Club的空間還是在互聯網平臺貸的高速增長。或許正如《經濟學人》所說的,未來的世界,我們不需要將存款放到銀行中去了。Lending Club在今年4月也收購了Springstone Financial,讓其貸款產品增加到教育基金和醫療基金。可以說Lending Club也在豐富其產品線。隨著Lending Club的上市,其和競爭對手Prosper的距離越來越大。而之前說過,Lending Club自有的大數據風險控制系統也因為交易額的增加,這條護城河也將越來越深。相信,未來3-5年,Lending Club依然能保持美國P2P市場的絕對龍頭地位,享受行業的高速增長。當然,其風險也有幾個方面:1)基於FICO分數的風險控制系統讓其很難向海外市場拓展。而且即使拓展,各個區域也會有自己國家的P2P平臺完成卡位;2)美國進入加息周期後,Lending Club的高利率貸款吸引力會逐漸減少;3)一些可能的黑天鵝事件導致其信用體系出現巨大漏洞。

無論如何,Lending Club可能是今年最後一個有趣的IPO公司,而筆者也相信這個“新的資產類別”公司會給投資者帶來一些的驚喜。

本文為點拾原創,未經許可,不得轉摘!

歡迎關註微信號:deepinsightapp

Shadow Banking再現?

2015-01-08 NM近日內銀股升到嘭嘭聲,識睇,一定睇埋呢輪一樣掃內銀掃到手軟、急速冒起嘅安邦保險。安邦保險近月成為民生銀行、招商銀行大股東,又持有工商銀行A股,佢仲喺海外收購有百年歷史嘅老牌酒店Waldorf Astoria。(Waldorf 除咗係美國駐聯合國大使官邸,亦係好多總統首相下榻嘅酒店,唔嘢小也!)跟手又收購老牌比利時保險公司同銀行。計吓數,舊年一年已使咗逾六百億!呢間公司○二年註冊資本五億,而家急增至六百一十九億,總資產達七千億元,真係好疊水。 咁啲錢點嚟o架?睇揸弗人咩料囉,市場一直傳由鄧小平外孫女婿吳小暉牽頭,開國元帥陳毅個仔陳小魯、朱鎔基個仔朱雲來、首創集團董事長劉曉光等等有份,即係紅二代。 再睇睇安邦嘅P & L,佢哋保險收入來源十二億五千萬,當中99.3%都係「分紅業務」,其他如壽險、意外險同健康保險,總共只佔0.7%。呢啲分紅業務就即係理財產品,安邦會搵大量內銀代銷。即係賺到錢,又走去投資內銀股。內銀升價,資本又可以借俾安邦發展,實行塘水滾塘魚。 講吓講吓,令人諗起當年雷曼兄弟同影子銀行,小宗真係怕怕。 早於○八年,大陸銀監會及保監會已規定,保險機構參與控股銀行數量不得超過兩間,但安邦竟可以成為三間銀行股東。何止有阿爺祝福,係阿爺有份呀,今年仲排隊來港上市,其他民企恨都恨唔到! 踢竇白沙灣隱密談情竇 踢咗竇咁耐,無理由唔踢啲談情私竇。位於西貢三星灣的白沙灣遊艇會,夠晒隱蔽,連李澤楷同緋聞女友撐枱腳,都係揀呢度。呢個會英文名叫Hebe Haven,Hebe喺希臘神話中象徵青春女神,簡直切合埋主題啦!遊艇會歷史有四、五十年,聽落遊艇會好似富豪級玩意,但實則入會資格相當大眾化,個人會籍只需六皮,公司會籍亦只係十二萬,遊艇會之中絕對係平民價。而個會睇準後生仔鍾意玩水上運動,為咗年輕化,小宗問過,二十六至三十歲組別會籍半價,只需三皮,二十一至二十五歲組別半價再半價,只要一萬五千。再後生啲,十八至二十一歲嘅,六千蚊搞掂!筍就筍,不過waiting list兩年咁耐。遊艇會中嘅餐廳,午市揀set lunch就最抵,價錢由七十八蚊到一百四十八蚊。以咁嘅價錢,包前菜(沙律/湯)主菜同飲品,算抵食。餐廳保留殖民地時期留落嘅傳統英式裝潢,個bar仲有個大鐘,last call / last order時侍應會敲一下鐘向饗客示意,好british!不過唔知係咪日久失修,部分地板出現少少凹陷。今次試個西檸雞飯,西檸雞好厚炸漿,咬落漿住口;牛扒套餐件牛扒亦只不過不失,不過來談情嘅,食咩都咁好味。呢度會員大半係金髮碧眼嘅外國人,配合四面靚景有山有海,藍天白雲,仲以為去咗南法海岸添! 難怪小小超唔怕偷影,成日來偷……呀唔係,係談情。爽喎! 胡應湘伯爺點發跡 上輪灣仔跌錢事件,執到錢嘅一班街坊就好似發咗場春秋大夢,還嘅還、匿嘅匿。最搞笑係有人將錢放喺屋企床下底,以為最危險嘅地方最安全,點知人贓並獲! 呢件事令小宗諗番起段舊聞。嗱!而家大地產商胡應湘,係人都知佢伯爺胡忠揸的士起家,後來儲落多部的士成為「的士大王」。傳聞有日佢揸的士,有個客大懵,留低咗大堆花旗紙(美金)喺佢處。個客後來當然報警,但警察摷到去胡忠屋企,搵埋床下底,咩都搵唔到!結果事情不了了之。過咗一段時間,胡忠就有錢大力投資,成就咗之後嘅故事。早年傳到街知巷聞時,胡應湘曾走出來代父否認澄清。其實講真,如果有筆橫財都無智慧用來投資,反而攞去過大海,咪一樣一場空,你話係咪? 劏房波嫁女貫徹新亞精神 劏房波做外父,聖誕後三日於四季擺嫁女酒。不惜紆尊降貴,親自打電話俾新亞校友,請佢哋撥冗光臨,以增榮寵,更加拍晒心口,一定準時八點開席,絕無花假。結果?咪一樣搞到九點幾都未起到筷。 非但餓親班校友,連689亦一樣領嘢。所以話呢,啲人慣咗手勢,一次冇句真,就永世都冇句真;即使嫁女請飲亦唔例外,話之你係神明子孫又點啫。莫非劏房波要藉呢餐嫁女酒等班校友毋忘「餓我體膚勞我精」嘅新亞精神 ? 金牙大狀講嘢法國大餐競委會 班人以惠康、百佳、華潤瓜分超市天下,指證香港有寡頭壟斷,由是成立由胡紅玉擔大旗之競爭委員會以保障消費者利益。點知委員會尚未嚟得切運作,成個市場已經俾林偉駿之759阿信屋翻轉。寡頭壟斷云乎哉?俗語有云,冇鬼唔死得人。同樣,冇政府干預唔會有壟斷。林老闆喺四年間開咗超過兩百間鋪,引發優品360等爭相效顰。零食以至超市有否壟斷,睇怕都唔使多講矣。點解佢哋可以輕易入市?政府冇架起門檻阻止佢哋入市囉。本來無一物,何處惹塵埃?個市本來充分競爭,班人則以促進競爭為名搞干預。結果會係乜?胡主席為咗證明其存在價值,你估佢會任得市場自己搞掂,抑或諸多干預呢? | ||||

Next Page