- 股票掌故

- 香港股票資訊

- 神州股票資訊

- 台股資訊

- 博客好文

- 文庫舊文

- 香港股票資訊

- 第一財經

- 微信公眾號

- Webb哥點將錄

- 港股專區

- 股海挪亞方舟

- 動漫遊戲音樂

- 好歌

- 動漫綜合

- RealBlog

- 測試

- 強國

- 潮流潮物 [Fashion board]

- 龍鳳大茶樓

- 文章保管庫

- 財經人物

- 智慧

- 世界之大,無奇不有

- 創業

- 股壇維基研發區

- 英文

- 財經書籍

- 期權期指輪天地

- 郊遊遠足

- 站務

- 飲食

- 國際經濟

- 上市公司新聞

- 美股專區

- 書藉及文章分享區

- 娛樂廣場

- 波馬風雲

- 政治民生區

- 財經專業機構

- 識飲色食

- 即市討論區

- 股票專業討論區

- 全球政治經濟社會區

- 建築

- I.T.

- 馬後砲膠區之圖表

- 打工仔

- 蘋果專欄

- 雨傘革命

- Louis 先生投資時事分享區

- 地產

Random Tags

投資休養期:學而不思則惘 Consilient Lollapalooza

From

http://consilient-lollapalooza.xanga.com/715832741/%E6%8A%95%E8%B3%87%E4%BC%91%E9%A4%8A%E6%9C%9F%EF%BC%9A%E5%AD%B8%E8%80%8C%E4%B8%8D%E6%80%9D%E5%89%87%E6%83%98/

I am a person who is curious on knowledge and have the passion to improve what I am doing. In investing, I always try to improve my capability by learning different schools of philosophy. Value investing, cigarbutt, program trade, chart, event trading, seasonality, macro, you name it. Yet, those KNOWLEDGE only help me understand why things happen from the own perspective of each knowledge, but they don't quite help me draft a executable guileline. I have learnt 10 set of knowledge but each time I can only use 1 of them or even less. I know I need to clarify the contradiction among theories and dig into their inner mentality in order to unleash the potential of the knowledge.

My friends are surprised how fast I equip TA. I am surprised so too. I think my TA trade have over 200% gain YTD, bring up my whole portfolio return bla bla, bla. TA exists as a knowledge and rules within my mind since 2003 acutally, but the knowledge cannot be used because the VALUE of TA simply contradict to my core value investing mindset. And I have failed to discover the value behind TA in order to unleash its potential. After the financial crisis, I got the KEY of risk management and the potential of TA knowledge start to show its importance then.

However, I am not satisfied with TA and value investing individually. I target to develop my own metal model to accommodate their contradiction. Some people may think that I am silly because that's unlikely to yield good result. Maybe. But I firmly believe that innovation is a source of great profit and that's a reward for those who proceed despite of large resistance from the norm. If fails, I go back to either of knowlege. What's the risk reward profile then?

If we have the right mindset(value and belief), we can have the right rules to execute with discipline. If not, probably we would be stuck in confusion and need to count on our emotion to make the choice. That's what we want to avoid.

Value Investing

Value

- Rationality

- Indepentence

- Discipline

- Permanent

- Realism

Meta Belief

- Regression to value

- Mr. Market Hypothesis

- Margin of safety, no leverage, diversification can tackle short term negative outcome.

Value belief

- Permanent Value

= Sum of future FCF

Good Value

= sustainable advantage + good managers

Cigar Butt Value

= Relatively cheap, no edge

Undervaluation belief:

- Price-anchoring

- Event Driven

- Mis-catagorization

- Market

Optional Belief

- Regession of marco value outweight that of micro value

- Margin regression consideration

- Economic Cycle consideration

Questions:

1 Future FCF - how to calculated? Based on what? how to do so rationally?

2 Macro consideration, economic cycle, to be ignored? yes, then? no then?

3 Under-valuation belief? how to know? when to act? why?

etc.

PermaLink: https://articles.zkiz.com/?id=12428

重庆新天地考察报告 大头阿不思

http://xueqiu.com/9185767415/42683463重庆新天地分为四个部分,一是住宅部分,主要是雍江苑、雍江翠湖等楼盘,二是重庆天地部分,主要是商铺,三是企业天地部分,主要是七栋错落有致的办公写字楼群,其中第七栋还没建成,四是嘉陵天地部分,主要是企业天地底部的商用楼层。

这次考察时间不长,并不细致,粗略了解后主要有以下几点印象:

第一,住宅部分基本都卖光了,现在在卖雍江翠湖,售价大约为一万出头,值得注意的是重庆都是卖建筑面积,因此相当于八五折之后八千五左右均价。销售人员介绍比较好卖,不愁销售,但购买者多为投资客,因此没有什么人住。剩下靠天地湖边一片小地,可能很长时间都不会开发,我猜测是会用于开发高档楼盘。

图为建设中的雍江翠湖。

这是正在开卖的雍江翠湖,下面靠嘉陵江侧的低矮建筑群就是重庆天地。

第二,重庆天地构建错落有致,建筑漂亮,但就是招商有问题,大量空置商铺,现存的商铺较为同质化,缺乏人流。晚上吃饭的人也不多,很多桌都空着。就此看,铺租的成长性应该成问题。

上面是重庆天地的几张图片,拍少了,但可以告诉大家的是确实没什么人流。

第三,企业天地目前建成了2至7号楼,最高的主楼1号楼正在建造中,但多方面的消息说这栋楼可能会拖延工期。

第四,据说嘉陵天地因为企业天地未完工也没有开业。

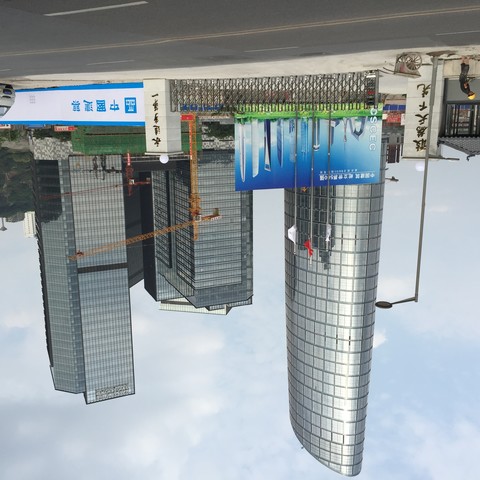

图为一号楼工地,看来是还没出地面,还在做基坑。而且据说也不会太快竣工。

图为从天地桥遥看企业天地组楼群。

介绍完情况,要说说我的一些分析和看法。

首先可以肯定地是,瑞安的建筑设计和质量应该是精品,甚至可以说是艺术品,重庆天地最火的行业是婚纱摄影,我们看到最多的人流就是这些披着婚纱到处取景的人群。这从一个侧面说明了重庆人对它的肯定。

其次,瑞安在重庆最大的问题是不接地气。怎么说呢,首先是选地有问题。重庆人的消费习惯是商圈消费,可能是因为山城,形成了点对点的城市格局,重庆新天地刚好位于解放碑、沙坪坝、大坪、观音桥几个核心商圈之间,地理上是核心,但反过来看是被这些商圈包围,加上交通不便没通轻轨,小区缺乏住户没带来人流,造成了重庆天地曲高和寡的感觉。其次是招商有问题,我举一个例子,我们在重庆天地跑了一下午,后来想买瓶水喝,居然只能在咖啡厅买22元一杯的进口矿泉水,除此外没有选择。大量的商铺处于空置状态。第三,我拿到一份嘉陵天地的招商计划,其中列出的重庆民俗饮食博物馆,据重庆亲戚介绍大部分的食家都缺乏特色。我认为这些可能是瑞安的高管太骄傲了,没有去深入了解重庆的特点,瑞安在重庆的管理层缺乏动力和执行力,最终导致了这一局面。

第三,企业天地前景不明。瑞安在这里想打造一个重庆的金融中心,高档写字楼区。但是重庆市的规划金融中心是在江北嘴,目前大部分的金融机构都把总部放在了江北嘴。企业天地凭什么来抢生意?这值得深入思考。

第四,我认为最坏的情况已经出现,剩下都是转机。重庆天地门可罗雀,不能再坏了,企业天地待2017年轻轨9号线通车后,届时配合1号楼重庆第一高楼的噱头,加上嘉陵天地的商圈人流,也许会迎来招商引租的高峰。此外,重庆人的消费习惯也不是不能变化,因为重庆目前私家车保有量大幅上升,这会带来消费习惯的深刻变化,今后也许交通便利,空间开阔舒适在消费选择的权衡中会变得越来越重要。当然,最关键的是瑞安重庆管理层要切实从股东的利益出发,提升自己的办事效率,敬畏市场,深入了解重庆特点,做好招商引租工作。幸而最近的员工激励计划可以提供动力。

PermaLink: https://articles.zkiz.com/?id=143438

Next Page